- #Quicken starter for mac review for android

- #Quicken starter for mac review download

- #Quicken starter for mac review free

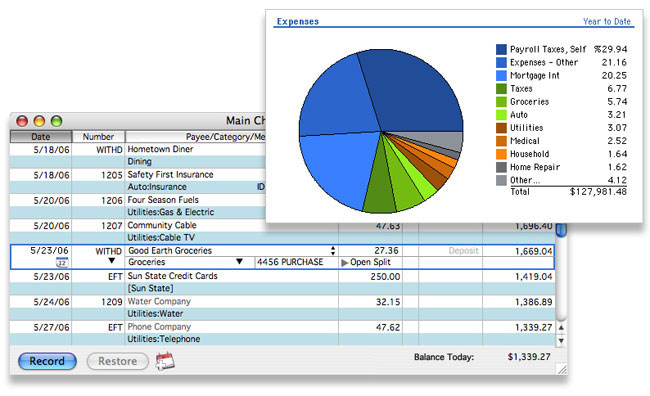

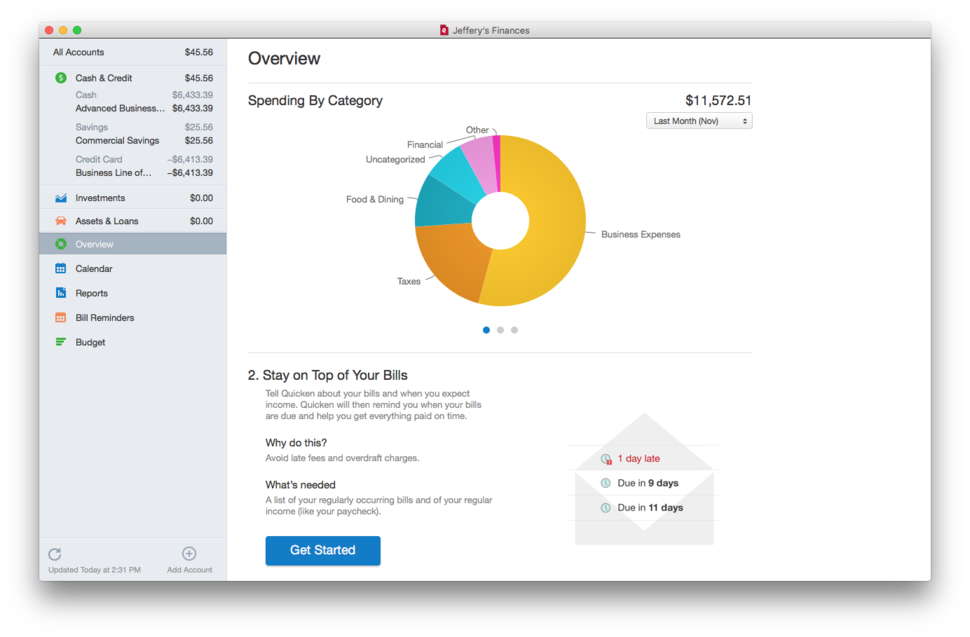

Split transactions for an accurate view of spending. Enter transactions as you spend even when you are not connected to the internet.

See spending trends and check your budget.* View your balances, accounts, and transactions. Automatically syncs your desktop and mobile data. STAY CONNECTED TO YOUR MONEY ANYTIME, ANYWHERE

#Quicken starter for mac review download

If you currently don't have Quicken on your desktop, please visit us at to download our top personal finance software. We stand behind our products with over 30 years of experience and a 60-day money back guarantee.

#Quicken starter for mac review for android

The Quicken Mobile Companion App for Android syncs with Quicken desktop, so you can make smart decisions with your money no matter where you are.

#Quicken starter for mac review free

If you limit your rate shopping to a month or so, credit bureaus will understand that you're looking for a home and shouldn't hold each individual inquiry against you.The Quicken Mobile Companion App is a free personal finance app to use with your Quicken desktop software. A bunch of hard inquiries on your report can hurt your credit score - unless it's for the sake of shopping for the best rate. When you apply for preapproval, a lender does a hard credit inquiry. With a few preapproval letters in hand, you can compare each lender's offer. When you're preapproved, your mortgage rate is locked in for 60 to 90 days. A preapproval letter states that the lender would like to lend you up to a certain amount, at a specific interest rate. Once you're ready to start shopping for homes, apply for preapproval with your top three or four choices. You also want it to offer good rates and charge reasonable fees. You shouldn't need a super high credit score or down payment to get a loan. The best mortgage lender will be different for an FHA mortgage than for a VA mortgage.Ī lender should be relatively affordable. How do I choose a mortgage lender?įirst, think about what type of mortgage you want. You'll also get a lower rate with a shorter mortgage term. Government-backed mortgages (like FHA, VA, and USDA loans) charge the lowest rates, while jumbo mortgages charge the highest rates. The better your credit score, debt-to-income ratio, and down payment, the lower your rate should be.įinally, your mortgage rate relies on what type of mortgage you get. When employment numbers and inflation go up, mortgage rates tend to increase. The two main economic factors that impact mortgage rates are employment and inflation. Interest rates tend to be higher when the US economy is thriving and lower when it's struggling. Mortgage rates are determined by a combination of factors - some you can control, and some you can't. This is a riskier approach these days, because ARM rates are starting higher than fixed rates, and you risk your rate going up later. A 5/1 ARM locks in your rate for the first five years, then the rate fluctuates once per year. This is an especially great deal right now, as rates are at historic lows.Īn adjustable-rate mortgage keeps your rate the same for a predetermined amount of time, then changes it periodically. Even if rates in the US market increase or decrease, your rate will stay the same.

A fixed-rate mortgage locks in your rate for the entire length of your mortgage.

0 kommentar(er)

0 kommentar(er)